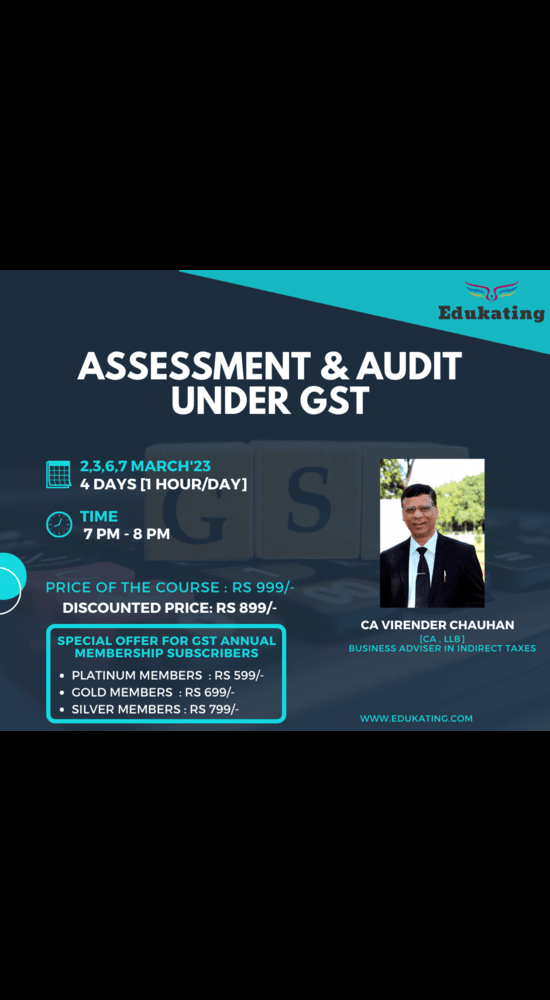

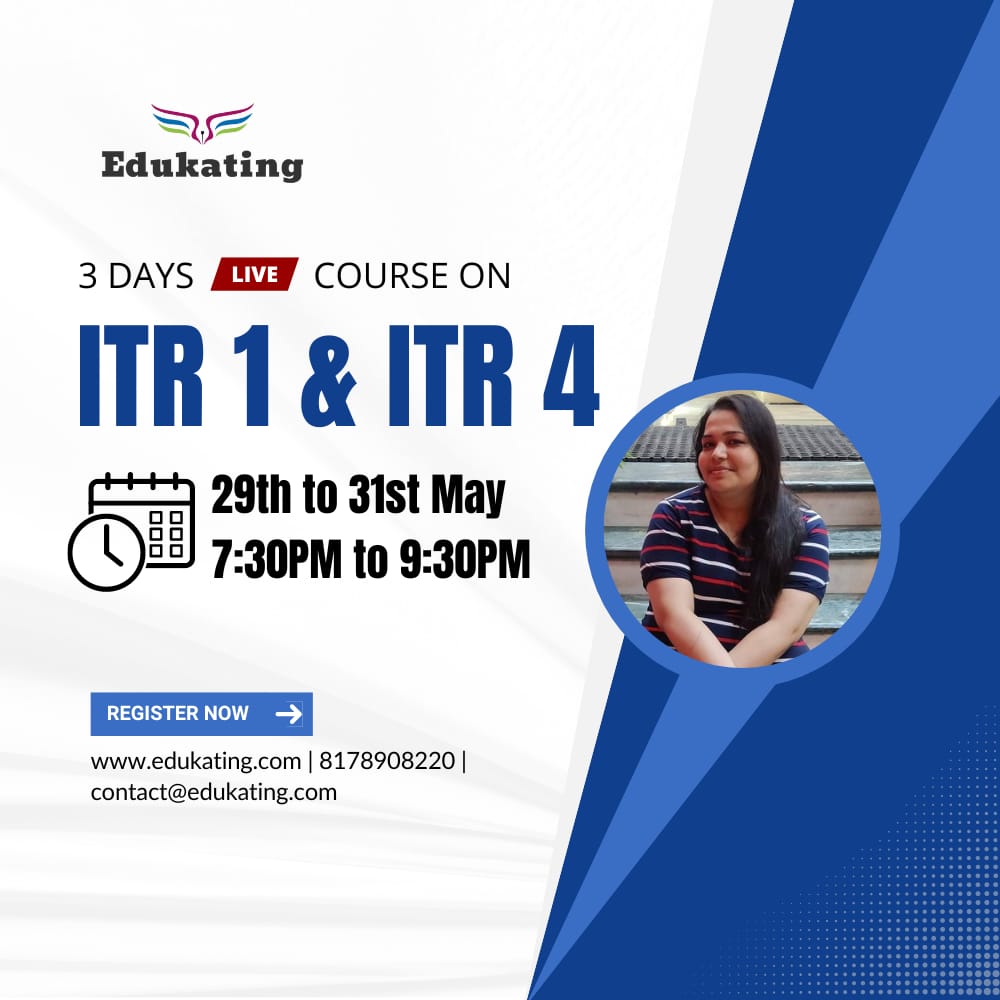

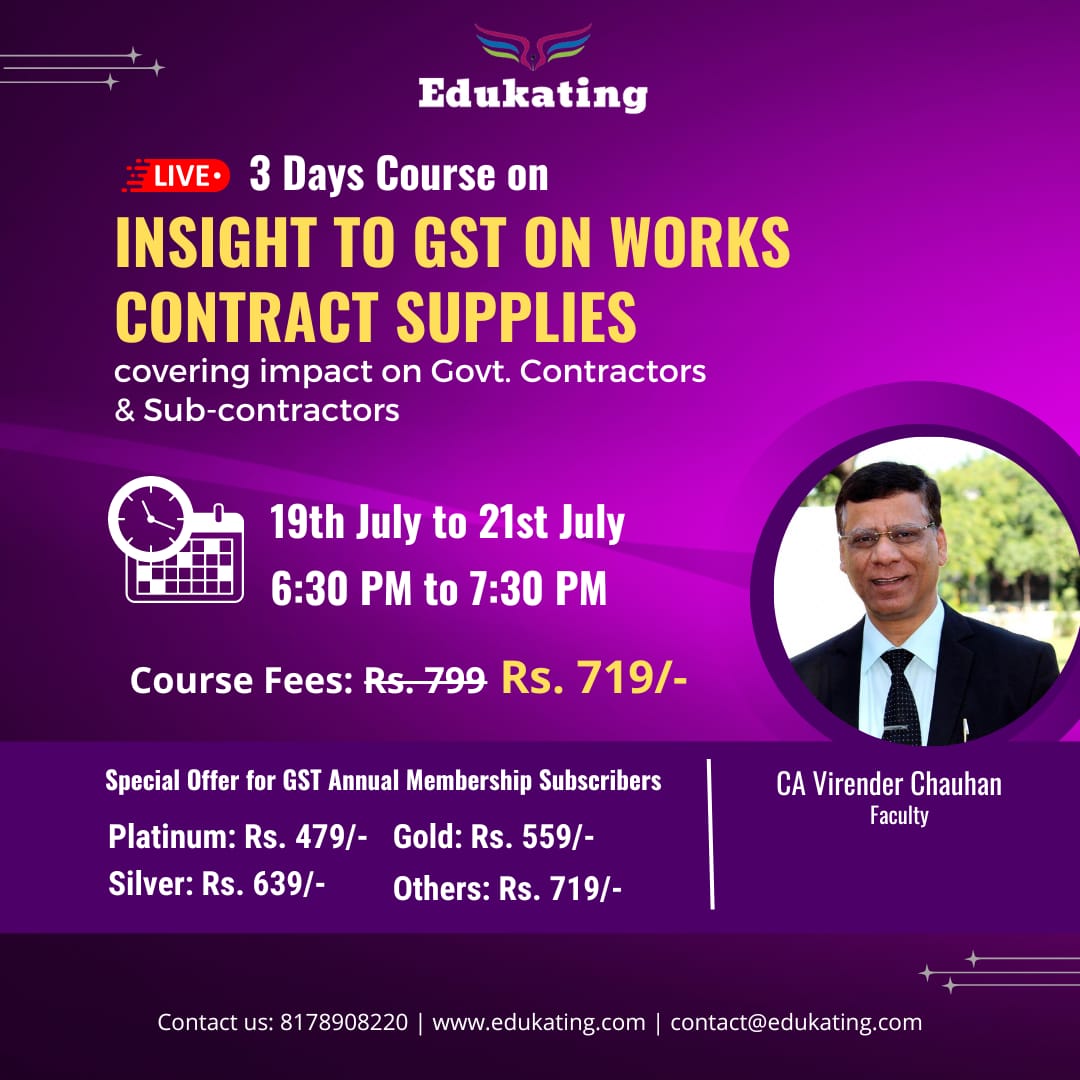

GST Annual Membership Oct'25

We are pleased to introduce Edukating’s GST Annual Membership (Oct’25), thoughtfully designed for professionals, business owners, and GST learners who want to stay updated, compliant, and confident in handling GST matters with expert support throughout the year.