An e-commerce operator refers to a person or entity that owns, operates, or manages a platform that facilitates the supply of goods or services between the supplier and end customers.

Via Notification No. 26/2022 - CT Dated 26th December 2022, two new tables 14 and 15 were added in GSTR-1 to capture the details of the supplies made through e-commerce operators. These tables have now been made live on the GST common portal. These two new tables will be available in GSTR-1/IFF from January-2024 tax periods onwards.

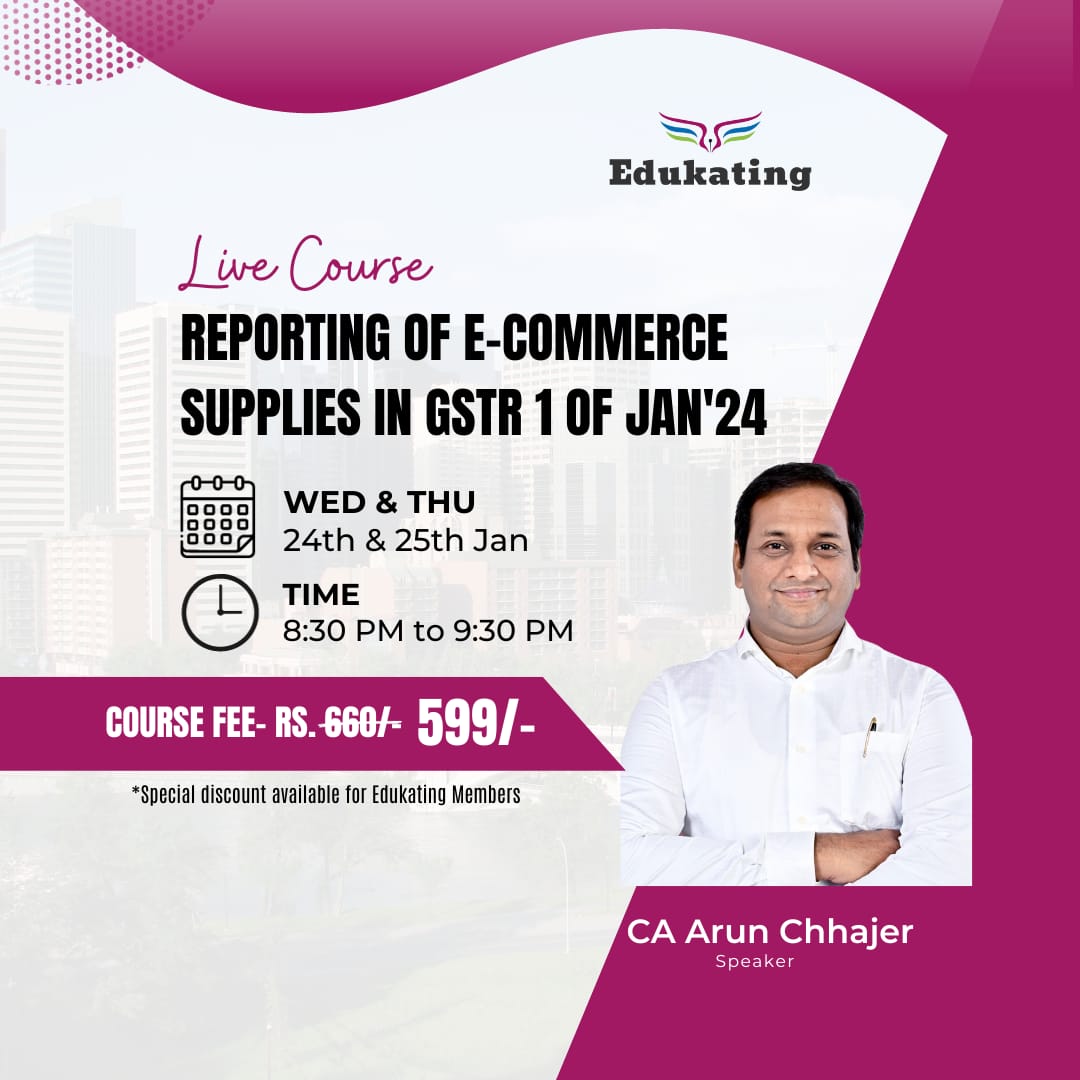

The recent live course by Edukating will focus on the reporting of E-Commerce supplies in GSTR-1 of January 2024. The reporting of the said transaction will be taught live on the GST Portal with help of relevant case studies and examples along for a better understanding of the concept.

Details

Price of the course - Rs 660/-

Special offer for GST Annual Membership subscribers

Payment Link : https://rzp.io/l/6yZIizfr